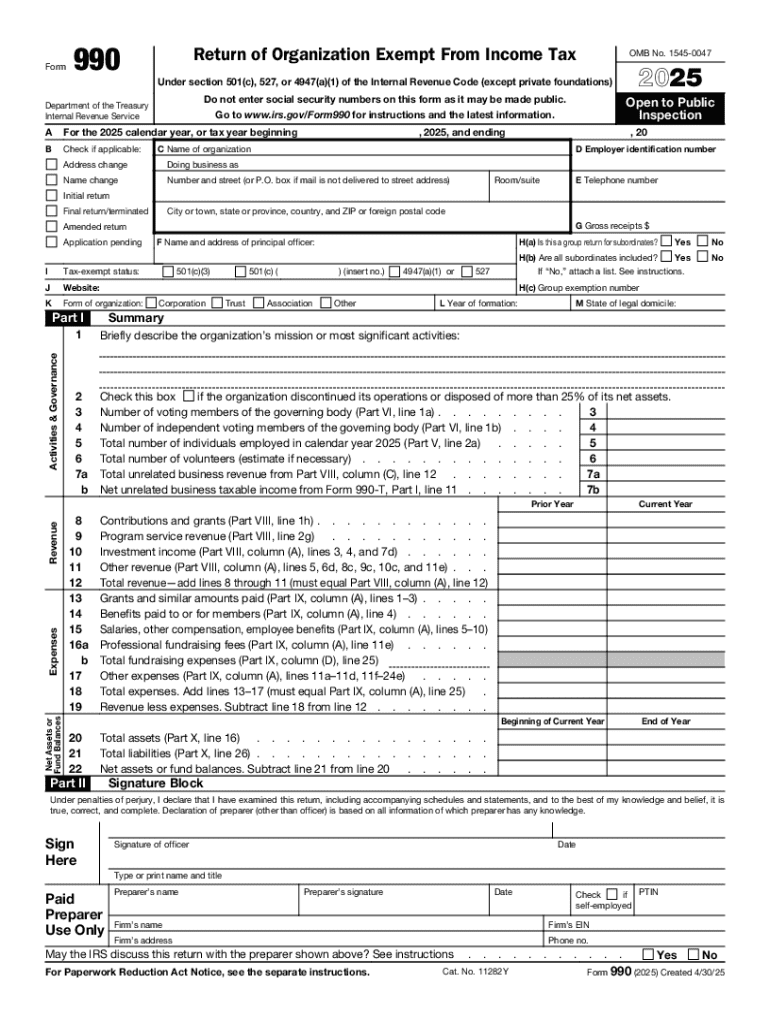

IRS 990 2025-2026 free printable template

Instructions and Help about IRS 990

How to edit IRS 990

How to fill out IRS 990

Latest updates to IRS 990

All You Need to Know About IRS 990

What is IRS 990?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990

What should I do if I realize I made an error after submitting my IRS 990?

If you discover a mistake after filing your IRS 990, you can submit an amended return to correct the error. It's important to clearly indicate that you are amending a previously filed form and explain the changes. Make sure to keep a record of both the original and amended filings for your records and reference.

How can I verify the status of my filed IRS 990?

To track the status of your IRS 990, you can use the IRS tracking system if you filed electronically. For paper submissions, it is recommended to wait at least 6 weeks before inquiring through the IRS hotline. You can check for common rejection codes if your e-file submission was unsuccessful.

What are some common errors to avoid when filing the IRS 990?

Common errors when filing the IRS 990 include incorrect EIN, missing signatures, and failing to enter amounts in the correct boxes. Double-check all figures, ensure that all required fields are completed, and review the information for accuracy before submission to minimize the chances of rejection.

Can I file my IRS 990 using a mobile device?

Yes, you can file your IRS 990 using specific software that is compatible with mobile devices. However, make sure your app meets the IRS's technical requirements for electronic filing, as not all platforms may support mobile submissions smoothly.

What should I do if I receive a notice from the IRS regarding my 990 filing?

Upon receiving a notice from the IRS about your IRS 990 filing, carefully review the contents of the letter for specific instructions. Prepare any requested documentation and respond promptly to resolve the issue, as failure to address the notice can lead to further complications.

See what our users say