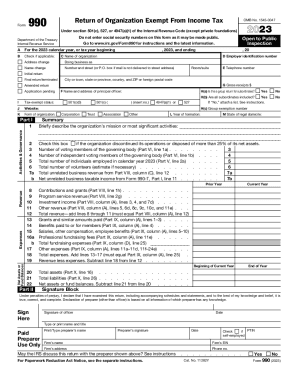

IRS 990 2024-2025 free printable template

Show details

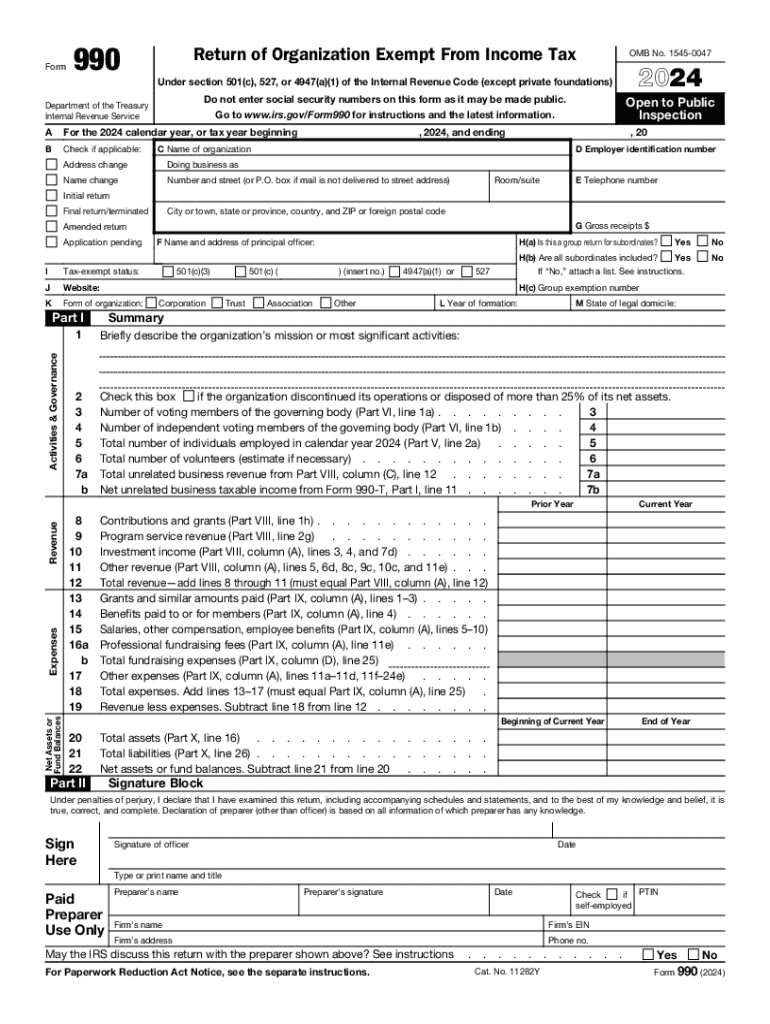

Phone no. Cat. No. 11282Y Form 990 2024 Page 2 Statement of Program Service Accomplishments Check if Schedule O contains a response or note to any line in this Part III prior Form 990 or 990-EZ. B If Yes has it filed a Form 990-T for this year If No to line 3b provide an explanation on Schedule O. X line Financial Statements and Reporting Accounting method used to prepare the Form 990 Cash Accrual Schedule O. Net unrelated business taxable income from Form 990-T Part I line 11. 7b 16a...

pdfFiller is not affiliated with IRS

Understanding and Navigating IRS Form 990

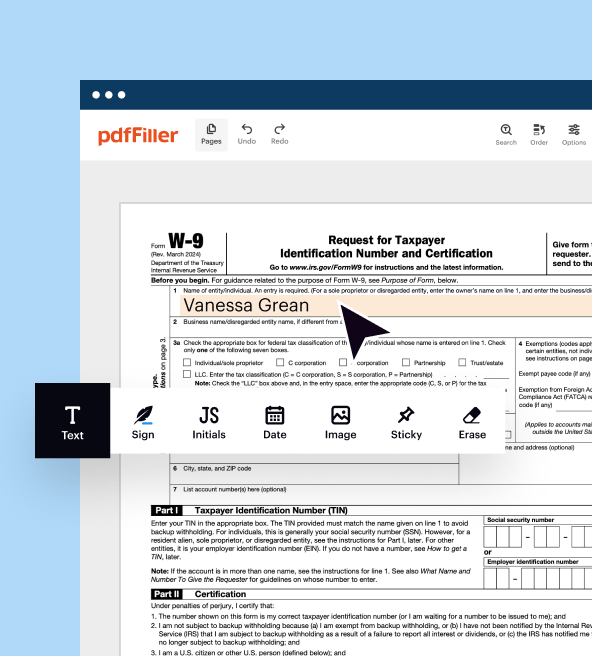

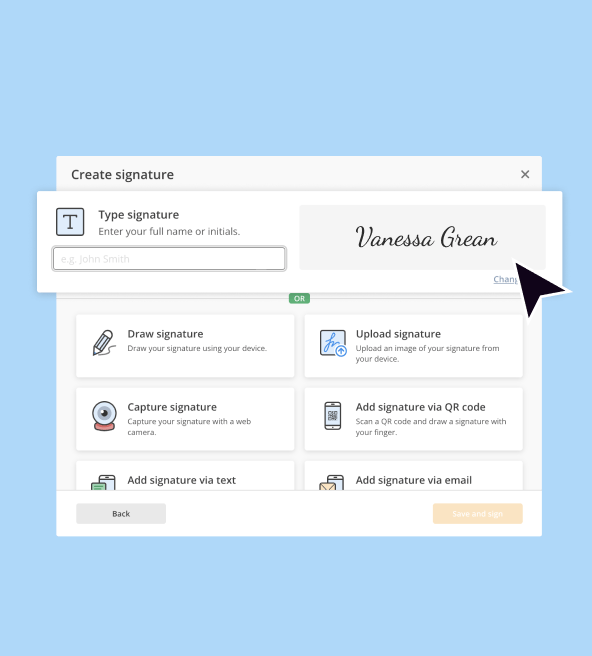

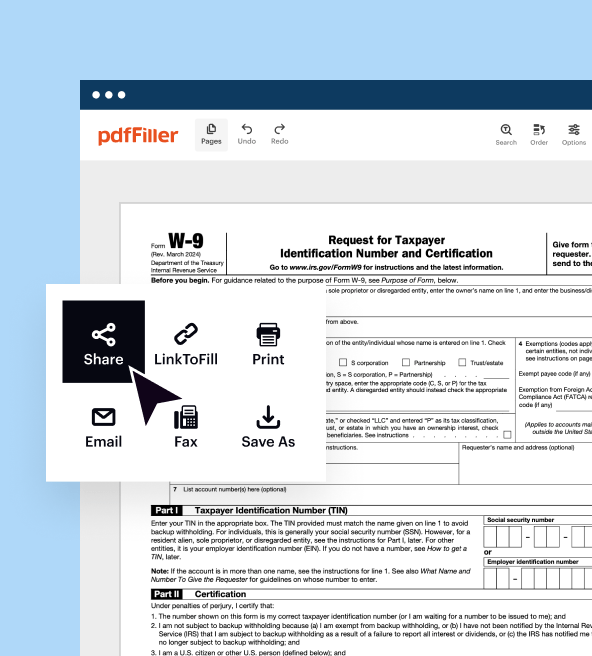

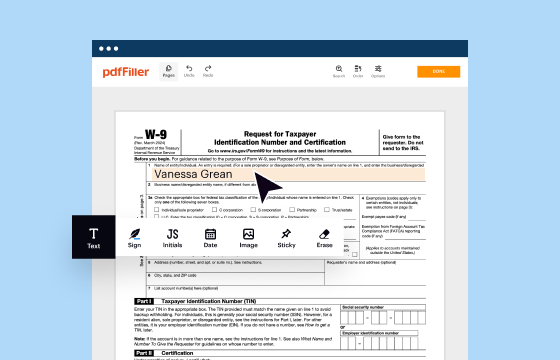

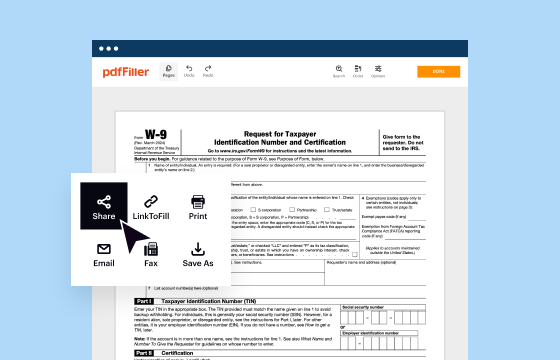

Step-by-Step Directions for Form Editing

Guidelines for Completing IRS Form 990

Understanding and Navigating IRS Form 990

IRS Form 990 is a crucial document for tax-exempt organizations in the United States, serving as a comprehensive report detailing their financial activities, governance, and performance. By filling out this form accurately, nonprofits ensure transparency and compliance, gaining the trust of stakeholders and the public.

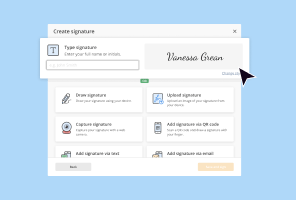

Step-by-Step Directions for Form Editing

Editing IRS Form 990 requires a meticulous approach to ensure all information is accurate and complete. Follow these steps:

01

Review the latest version of IRS Form 990 from the official IRS website.

02

Gather all relevant financial statements, including income statements and balance sheets.

03

Confirm that all required exhibits and schedules are included for your specific organization type.

04

Update contact information and organizational changes, if applicable.

05

Carefully proofread all sections for accuracy and consistency before submitting.

Guidelines for Completing IRS Form 990

Completing IRS Form 990 involves several key components. Here’s how to approach it:

01

Provide your organization’s name, address, and Employer Identification Number (EIN) at the top of the form.

02

Fill out the Statement of Revenue section, breaking down income into categories like donations, grants, and program revenue.

03

Complete the Functional Expenses section, detailing how funds are allocated across various services and programs.

04

Include information regarding governance, such as the Board of Directors and decision-making processes.

05

Ensure all financial metrics are supported by documentation and comply with IRS rules.

Show more

Show less

Recent Updates and Changes to IRS Form 990

Recent Updates and Changes to IRS Form 990

IRS Form 990 has undergone significant modifications, affecting reporting requirements and forms. Understanding these changes is critical for compliance:

01

New reporting thresholds for public charities have been introduced, reflecting inflation and enhancing transparency.

02

Form 990 now emphasizes disclosures related to compensation for employees, contractors, and board members.

03

Enhanced reporting requirements for foreign activity and transactions have been established.

Essential Insights on IRS Form 990

What is IRS Form 990?

What is the Purpose of IRS Form 990?

Who Must File This Form?

When is Exemption Applicable?

What Are the Components of IRS Form 990?

Filing Deadlines for IRS Form 990

Comparison of IRS Form 990 with Similar Forms

Transactions Covered by the Form

Number of Copies Required for Submission

Penalties for Not Submitting IRS Form 990

Information Required for Filing IRS Form 990

Other Forms Accompanying IRS Form 990

Submission Address for IRS Form 990

Essential Insights on IRS Form 990

What is IRS Form 990?

IRS Form 990 is the annual information return filed by tax-exempt organizations in the U.S. It provides the IRS and the public with an overview of the organization’s financial performance and compliance with tax laws.

What is the Purpose of IRS Form 990?

The primary purpose of IRS Form 990 is to promote transparency and accountability within the nonprofit sector. It helps ensure that tax-exempt organizations adhere to regulations while allowing potential donors to assess the financial health and operational efficiency of these entities.

Who Must File This Form?

Organizations required to file IRS Form 990 typically include:

01

Public charities with gross receipts over $200,000.

02

Private foundations regardless of income.

03

Tax-exempt organizations under section 501(c)(3)

When is Exemption Applicable?

Exemptions from filing IRS Form 990 apply under several circumstances:

01

Organizations with gross receipts under $50,000.

02

Certain religious organizations

03

Organizations that qualify for 990-N (e-Postcard) filing, which requires less detailed reporting.

What Are the Components of IRS Form 990?

IRS Form 990 consists of multiple sections and schedules that organizations must complete, including:

01

Core financial statements

02

Governance and management information

03

Program service accomplishments

04

Supporting schedules that provide detailed information on specific areas like compensation and fundraising expenses.

Filing Deadlines for IRS Form 990

The standard deadline for filing IRS Form 990 is the 15th day of the 5th month after the end of your organization’s tax year. For organizations operating on a calendar year, this typically means May 15. Extensions can be requested, granting an additional six months.

Comparison of IRS Form 990 with Similar Forms

IRS Form 990 has counterparts such as Form 990-EZ and Form 990-PF:

01

Form 990-EZ is a simplified version available for smaller organizations with less complex financial situations.

02

Form 990-PF is specific to private foundations and focuses on their specific financial intricacies.

Transactions Covered by the Form

IRS Form 990 covers a wide range of transactions including:

01

Grants and contributions received.

02

Compensation for services rendered.

03

Programmatic expenses.

Number of Copies Required for Submission

Generally, organizations are required to submit one copy of IRS Form 990 to the IRS, as well as to make it publicly available, usually by posting it on their website or providing it upon request.

Penalties for Not Submitting IRS Form 990

Failure to file IRS Form 990 can result in severe penalties, including:

01

A fine of $20 per day, up to a maximum of $10,000 for organizations failing to file on time.

02

Loss of tax-exempt status for organizations failing to file for three consecutive years.

03

Potential for both financial and reputational harm if the organization is caught evading filing obligations.

Information Required for Filing IRS Form 990

Organizations must provide various details when filing, such as:

01

Tax identification information, including the EIN.

02

A complete list of directors, officers, and key employees.

03

Comprehensive financial statements covering all income sources and expenses.

Other Forms Accompanying IRS Form 990

Depending on the organization’s size and nature, additional forms may be required, including:

01

Schedule A for public charity status evidence.

02

Schedule B for reporting contributions that exceed specific thresholds.

03

Schedule G for professional fundraising services.

Submission Address for IRS Form 990

Organizations filing IRS Form 990 should submit it to the IRS address specified for their region. Typically, this will be:

01

Internal Revenue Service

02

P.O. Box 12192

03

Covington, KY 4

By understanding the nuances of IRS Form 990, your organization can maintain compliance while promoting transparency and trust among stakeholders. If you're in need of assistance, consider reaching out to tax professionals or starting your form-filing process today.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Kind of difficult using the first couple of times. I'm still not sure if I'm doing everything correct.

The software is really good; however it can be improved.

Try Risk Free